Index:

UPDATED ✅ Want to learn more about initial cryptocurrency offerings? ⭐ ENTER HERE ⭐ Learn Everything! FROM ZERO! ⭐

In the world of investment with cryptocurrenciesone of the main ambitions of investors is to buy a crypto asset at the lowest possible price, in such a way that By selling it, you can get more profit.

However, this is not always possible due to the high market volatility. Nevertheless, ICOs or initial coin offerings allow traders and investors Have the opportunity of get a cryptocurrency long before its price explodes due to the success of the project that support it.

In this note we will show you absolutely all about investing in ICOSand all the aspects that you must take into account to achieve successful projects and that allow you to enjoy the benefits of finding the potential “New Bitcoin”.

What is an ICO?

An initial coin offering (ICO) is a way of financing blockchain projects, which consists of make an initial sale of a portion of the project’s tokens at a low price, which in principle is always lower than the price at which it will be listed on the different Exchanges worldwide. Is a “Market opportunity” since it allows you to acquire a cryptocurrency at a very low price, which, if successful, will allow you to multiply your initial investment.

Not everything is as simple as it sounds, since we run the risk of buying a token from a useless projectwhich instead of making us earn money, it would make us lose it since the token would end up depreciating, making our investment worth less and less. In 2016, after the first big Bitcoin boom, people were hysterical trying to find the new BTC or the new Ethereum. This caused the eye to be put on the ICOs.

Every month a new candidate appeared to destroy the dominance imposed by Satoshi’s crypto. But 8 out of 10 ICOS that were offered were actually junk projects, without a good structure, or in the worst case, blatant scams of people who once finished their ICOS, disappeared with the money in their pockets. That is why you should be cautious when choosing an ICO, otherwise you run the risk of falling into one of these false or potential projects that will end up making you lose money.

How does an ICO work?

A ICO It has a fairly simple operation. Once a project has been completed or is in an advanced stage of its development, those in charge of it proceed to offer a small portion of the total supply of the tokens at a much lower price than the day the token is listed on Binance or some other recognized exchange. This ICO is usually done privately, that is, not everyone has permission to participate.

In general, you have to earn the position by doing some other task for the dissemination of the project. Generally, to enter, simple things must be done, such as sharing a publication on the project’s social networks. or inviting a couple of people to get to know the project. Thanks to this, the token will start to spread, which will give you good publicityand in turn more and more people enter your ICO to get more funding.

Then the tokens are offered, but to guarantee the stability of the token, only a small portion is for saleand besides that the number of tokens a person can acquire is limitedin such a way as to prevent the entry of large cryptocurrency holders who seize a large portion of the supply before it even hits the market.

Differences between an ICO and a Presale of cryptocurrencies

Some people often confuse what is a ICO with a presale of tokens, which is a much earlier stage than the first. The differences between one and the other are few, but marked enough to be able to distinguish them perfectly. A token pre-sale is a stage prior to the sale of the tokens, that is, long before an ICO. This is a way to test the market to get an initial impression of the demand that the token could have in the future.

In this case, you can get the cryptocurrency at a price even lower than the one offered in an ICOwhich in principle should be enough to think that it is better to enter the pre-sale than the ICO, but it is not that simple. Pre-sales have many limitations. First of all, the supply that is offered is extremely low, which makes it much more difficult enter a whitelist.

In addition to that, you will not be able to dispose of the tokens you buy immediately, since these funds will remain blocked for a certain period of time. In general, the funds are released in phases, first you will be able to have 30% of the tokens that you bought, and then every so often they release the rest of the units that you acquired on the day of the pre-sale.

This is very risky since a new project is usually very volatile, creating a scenario in which the first percentage of what you bought can be sold at a higher price, since the price generally rises the first few days of launch, but with the passing of the weeks the interest is dilutedcausing the rest of the tokens that you release the losing sales.

Reasons to buy an ICO

Right now you must be wondering Why buy an ICO? and the truth is that it is a reasonable doubt.

But right now we will give you two reasons to do it in case you have it in mind:

It is a promising project

If the project that supports the token or cryptocurrency is solid, then it is undoubtedly a great opportunity since although few ICOs are successful, well-established projects have a fairly high potential for success. Some examples can be Cardano, that Long before the ICO was even launched, it was considered one of the most interesting projects in the crypto world.either Solarium that in 2021 managed to multiply its value more than any other cryptocurrency.

If we come across an interesting project that meets all the requirements for success, it would be very inopportune to miss the opportunity since when an ICO is successful, its participants make huge profits.

Long-term investment can be multiplied

If you have a little patience, you can leave the purchased tokens in a wallet and “forget” about them for a reasonable time until the project takes flight. This is undoubtedly a way in which you will multiply your investment exponentially.

How to know if an ICO will succeed?

If you are already thinking of investing in an ICO, let’s give you the information you need to know if a project can have real success in the world of cryptocurrencies, or if it is a potential failure more. since multiple projects without potential are still appearing.

Let’s see below:

Impact on pre-sale

The first sign that something is going well is in your foundations. The pre-sale can be a great indicator of the impact that is generating a project in the market. Generally when the foundations are solid, in pre-sales, tokens are usually sold to large companies that want to participate in their development. So if you check how the project went at this stage, and it turns out to be all right in that sense, that’s definitely a sign that things are on the right track.

Project and Roadmap

The project must be on track and its roadmap must be perfectly established. From there, investigates if they have met the previous objectives that they have marked on their Roadmap. If any of the points have failed, it is already a warning sign since if they have not been able to meet simple objectives, then there are no real guarantees that they will be able to meet more complicated challenges in the future. The only exception in this case is that the project proposes some new technology that has not been studied before.

For example, when the first consensus cryptos by Stake appeared, this protocol showed serious drawbacks that even now have not been solved, but being such a great advance to achieve a much cleaner blockchain mining, these problems were perfectly understood and the investors they believed in Polkadot, Cardano and other similar projects.

But if instead it is a simple idea that in principle only requires organization and discipline to carry it out and despite that the team shows deficiencies to fulfill them, then it is more than likely that when major challenges appear, the project will falter and ultimately fail.

Founders and developers

It is important that the founders and developers are recognizable. By this I do not mean that they are famous, but if it is important that they have a face. In general, if we come across projects whose founders are anonymous, the result will end up as a scam.

Although it is true that the Bitcoin, most powerful cryptocurrency in the world, it does not have a known founder, in fact it is not even known who he is, this is not a common denominator, and the correct thing is that the project has visible facesor what is the same, people to blame if something goes wrong.

Infrastructure

Obviously it is important that the company is perfectly constitutedboth legally and in its organization chart. We must know the country in which the headquarters are located, as well as if it is a multinational company. You must also know who is in charge of each thing within the company, that they have well-established positions and we can consult who all the members of the team are.

If any organization that calls itself a serious company does not comply with this point, then the project does not look good since this is something basic. Also make sure that their Internet platforms are well developed, not any web in HTML that is not even responsive.

marketing work

This point is key since it speaks a lot about the interests of the company. If we find a project that meets all the points mentioned above, and on top of that they have a good marketing job behind them, this can give you more security since it really is a team that dominates all the necessary facets to run a company. . If instead you come across a poorly set up project, with poor infrastructure and dubious developers.

And on top of that he has an excellent marketing job, so it’s a red flag and the chances are high that it is a scam. Just think about it, if these people they do not have time to develop a good website and organize their corporate structurebut instead of that they have invested a lot in promotions and publicity, which directly does not contribute anything to the development of the main idea of the project, it’s because deep down what matters to them is getting a juicy collection and not the success of their idea.

fundamental analysis

Once you have made sure that it is at least a legitimate project, it is the most difficult moment; know if it is really worth investing in it. For this, one of the best weapons we have at our disposal is fundamental analysis. This is nothing more than a detailed analysis of the fundamental aspects surrounding the sector in which the project is located. For this, it must be analyzed from the micro to the macro.

For the fundamental analysis are taken into account from the conditions of the world and local economy, to your competition and what are the possible obstacles that may arise in the way of the project. In this way you will be able to get a real idea of the chances that a cryptocurrency has of being successful in the future.

Token Utility

Another thing we should know is the utility of the token, since this will directly determine the demand that it will have. As usual It is often thought that the more utility a token hasthe higher its price, and this is not entirely true.

There are tokens like Bitcoin or Ethereum that have hardly any utilities within their network, but being cryptocurrencies of dominance, they become valuable assets to preserve value. What cannot be allowed is that the token has no use, in this case, without a doubt, the chances that it will appreciate exponentially in the future are small.

Is it mineable?

Another question you should ask yourself is if the cryptocurrency is minable or not.. This will mainly determine the scalability of the network. This point is not that important as there are currently extremely successful minable cryptocurrencies like BTC or ETH, as well as successful unminable cryptos like USDT and other stablecoins. However, it is important to know these details..

Amount of currency available

Another aspect that you should know is the amount of currency units that will be available. As usual, the lower the supply, the higher the growth potential of the token based on future demand. For this reason, those cryptos that have fewer units available are usually more successful.but this is in no way an indication of ‘success’ as we have successful cryptos like Cardano, which have a considerably higher supply than most.

Comparison with similar projects

Lastly, it is important to compare how other similar projects fared in the past. Not necessarily if others have failed it means that everyone will, but it is important to know how other similar projects acted to see if the new one is in favor of correcting the mistakes that its predecessors made, or if on the contrary they are correcting those mistakes made before. These are details that give more security when investing in a company.

How much money can be made with an ICO?

There are many factors that determine the amount of money that can be earned through an ICO. This is a variable that is based on the utility and its potential to mine the touch, marketing work, among other factors. Nevertheless, thanks to previous ICOs, it is possible to ensure that, by meeting the appropriate requirements and standardsan ICO can offer a substantial return on investment, depending on its reliability.

Taking NXT as an example, one of the oldest cryptocurrency projects, released in 2013. The financing campaign for this coin managed to raise the sum of $16,800 in Bitcoin for the distribution of one billion NXT tokens, giving the ICO of this cryptocurrency a value of $0.0000168.

Four years later, by September 2017, each NXT token was worth 1.95 USD, representing a return on investment of 11,547,519%, making it one of the most profitable ICO tokens in the current cryptocurrency market. So even though this is a game of probabilities, it is possible to generate excellent profits by doing the right job with your cryptocurrencies.

How to know if an ICO is not a scam?

Yes ok an ICO can be a great way to earn investment incomeprecisely that fame is what returns the ICOs one of the most common forms of scam related to Blockchainbesides one of the easiest to do.

With that in mind, there are signs you can look for to determine if this ICO is a suitable investment, or if you will end up losing your money it is a scam:

anonymous developers

As usual, investments and pre-sales of all kinds are promoted and carried out by persons whose identity is publicly knownand that they have a certain level of recognition within their community.

When this is not the case, i.e. when the ICO developers and promoters are anonymous, hiding their identity from an unknown user and not publishing information of any kind, it is generally a bad sign, and Although there are precedents of ICOs with anonymous developers that were very successful, it is a strong indicator that you should not invest in that project..

Suspicious or blacklisted addresses

The addresses of the wallets to which the funds raised in the ICO will be sent are of great value. There is a black list of addresses related to scams or SCAMso if the project in which we want to invest has sent money to an address of dubious reputation, then we must be alert since the chances of a scam are quite high.

Little pre-sale collection

In general, the results of token presales are a good method to define their potential for success, since these presales are attended by people who know about the organization and structuring of cryptocurrencies. With this in mind, low participation in token presales is a red flagwhich may indicate poor management by the developers, which could lead to losses for those who acquire these tokens.

Failures in the website or application

Nowadays, a website is a digital identity that says a lot about the level of a project. If the ICO website presents constant failures, as well as its application if it has onewe can certainly deduce that the developers do not have the necessary level to do something professional, which is a clear sign that the project could falter in the future.

Lack of team professionalism

Behind the ICO there must always be a companyso you should always check the details of it before starting any type of transaction. Make sure the company name and trade register are available and can be located on the web.

most countries they have a database in which they can check if any company is properly registered. In case it is not registered, it is an almost certain sign that it is not an ICO in which there is potential for profit.

Errors in token contracts

The contracts are an intelligent process by which transactions are regulated, and whose process is, in short, really simple. It consists of the creation, acquisition and transmission of tokens. However, any failure in any of the phases of the token contract can cause problems in the acquisition, as well as failures in possible transactions, generating losses for the owners of the token. Make sure all the terms of the contract are clear.

Learn how to buy an ICO

Initial coin offerings, ICOs have a very particular acquisition method, and the first thing you should do is make sure you enter the list of people who will have access to these tokens.

The method for this is described below:

Get on the ICO list

For get listed in an ICO, it is necessary to enter the website of the project or company that is obtaining financing through the offer. Over there, you can see what the project is aboutits central objective, and the methods to be able to register and enter the list of people who can obtain the ICO.

Necessary be especially careful with token offering campaigns that do not require any kind of registration. This is because, while it is still possible that it is a legitimate operation, most reliable ICOs currently require a registration process.

Get the main cryptocurrency of the project network

The Bitcoin and Ethereum are the most popular and widely used currencies in regular circulation. in the transactions of cryptoassets, and are the most predominant in the operations of ICOs, Regardless of the company that performs them.

Although the BTC is the most dominant currency today, ETH offers a stable enough blockchain platform for developers to fit their projects. For this reason, if you want to participate in an ICO; you will need to get Bitcoin or Ether. During the ICO, you can offer a minimum amount in BTC or ETH to acquire the equivalent in the offered currency. Usually the minimums vary between 10 USD and 100 USD, although that depends on the particular ICO.

Analyze the ICO

East it is a crucial step that you must take into account before starting with the transfer of funds. You need to make sure that the ICO is trustworthy and verify that your funds are safe, for which you do not need to take any precautions. To get started, you can verify the web address of the ICO site as many times as you think necessaryas you may come across fake ICO websites listed as advertisements that are high in authority and quite similar to the real sites.

Next, you need to make sure to thoroughly verify the project wallet address. This in order to avoid scammers and phishers posting fake addresses that aim to steal information from your wallet, causing you to lose it permanently.

Follow the steps indicated

In this point, You must be aware that there is no fixed formula of the steps to follow to register in an ICO since these vary from one to another, and are determined subjectively by the staff of token developers and published on the project website.

The steps they can range from sharing links to posting on social media. These steps should also be studied carefully to make sure that none are harmful to your information and funds, such as clicking on suspicious links or downloading unknown files.

Send your token and receive the new ones

Once you have completed the steps, the registration will be complete and you will be able to exchange your cryptocurrencies for the new tokenfollowing the minimum offer indications available on the website.

As directed by the ICO instructionsyou need to deposit the coins from the project wallet address provided to you, in order to acquire its equivalent in the token itself. The amounts you can bid may vary according to what is established by the developers.

Wait a while and sell your tokens

Once the ICO has finished, you will have the new tokens in your wallet. You should make sure it is private and that only you can control your funds. After some time, you will be able to see the evolution in the value of the tokens and you will be able to sell them. All that’s left to do is wait for the token to be listed on an exchange, at which point you can either sell it for your profit, or hold the token to wait for it to increase in value, and so on. increase profits over time.

Best websites to learn about new ICOS

The ICO’s are one of the most popular ways in which cryptocurrency investors can access new tokens relatively safelyso there is always a demand for quality websites that offer information about these offers.

Here are the best sites and platforms you can go to for quality information on the latest ICOs:

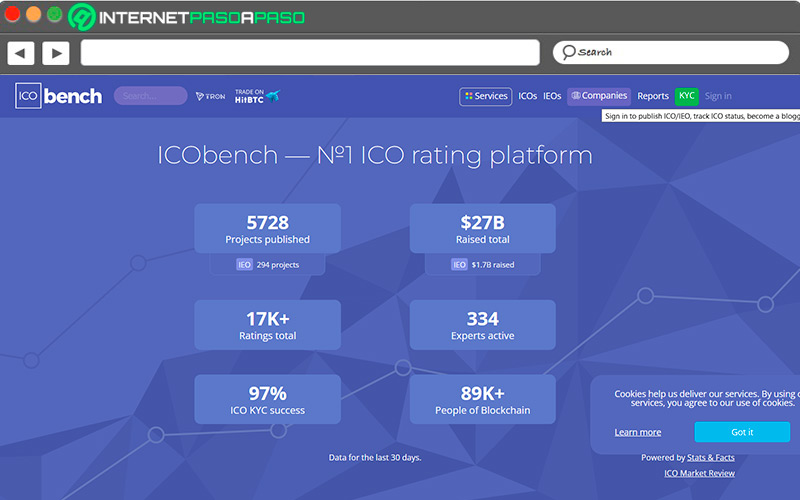

IcoBench.com

ICObench is a blockchain community that also works as a free ICO rating platform, which is supported by a wide variety of experts who provide information to investors. The site’s advisors cover a wide range of knowledge, from an analytical, legal and technical point of view, on the new tokens offered in the blockchain market, providing buyers with valuable information about their tokens.

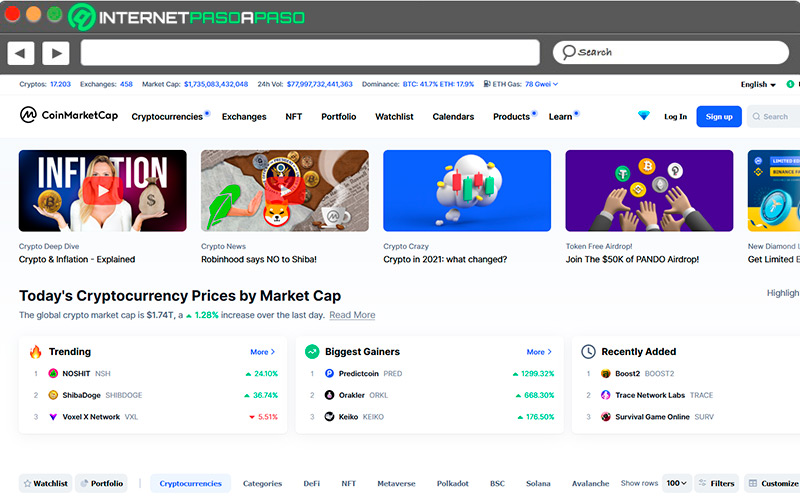

CoinMarketCap.com

It is one of the world’s most recognized price tracking and token analysis websitewhose value is increasing in the increasingly expanded world of cryptocurrencies.

allows the discovery of new cryptocurrencies from early stages of their development, as well as ICOs and pre-sales of new tokensproviding retail users with accurate and quality information by which they can reach informed conclusions about the usefulness of the token for their purposes.

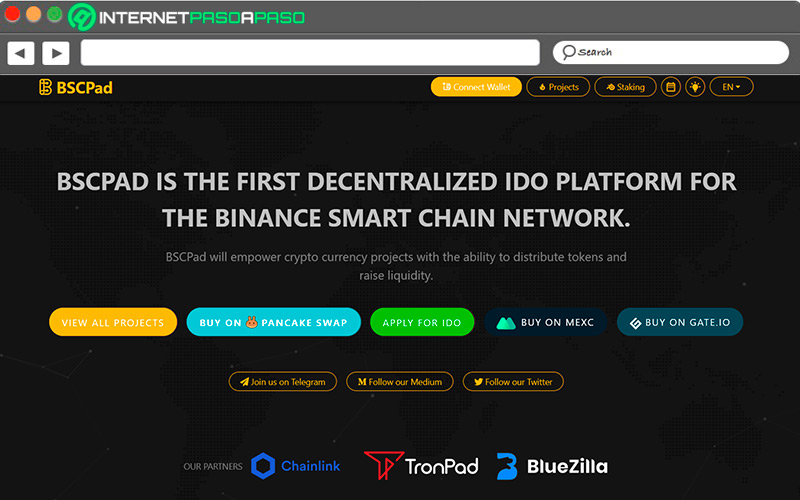

BSCPad.com

BSCPad is a decentralized platform designed for the platform Binance SmartChain Network, through which you will have access to updated information regarding a wide variety of tokens. Particularly, you will have exclusive access to ICOsand presales of new cryptocurrencies, with access to information about the developers and analysis of the viability of the tokens by experts in the field of crypto assets.

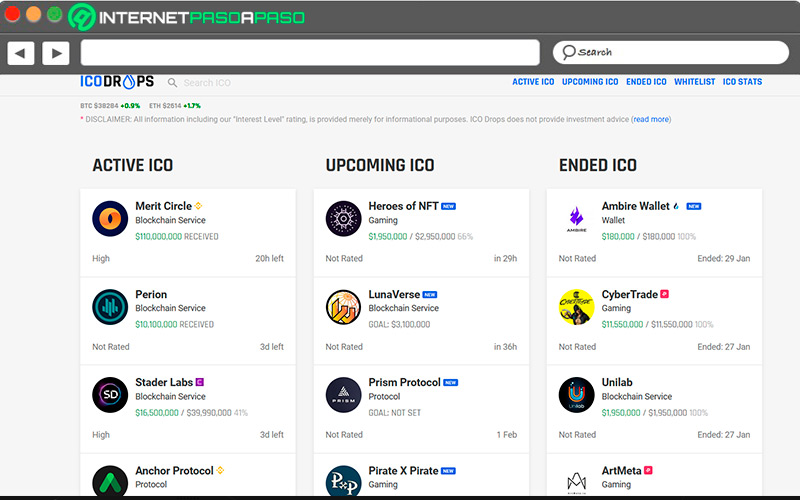

IcoDrops.com

this platform contains constantly updated lists, which are divided into three particularly useful sections: Active ICOs, upcoming ICOs and completed ICOs. These lists are up to date and visible to anyone who is interested. In addition, each ICO is complemented with its own metrics, through which you can guide yourself to determine the viability of the particular ICO, and you can generate your own conclusions according to the information collected.

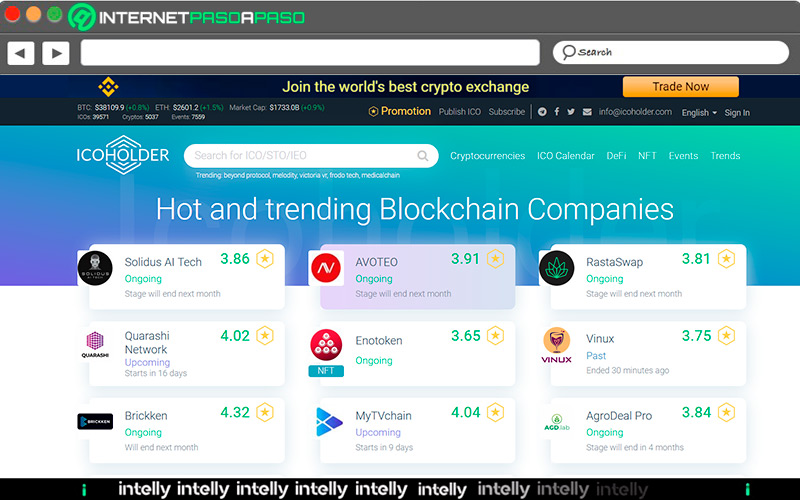

IcoHolder.com

IcoHolder is a global smart stat tracking company, which has the largest cryptocurrency database in the world, and through which investors and buyers can access real-time information on the cryptoactive market. IcoHolder produces a large number of metrics regarding each available crypto, plus a comprehensive list of new ICOs and presales to which investors have access to determine whether or not they will be profitable for their objectives.

Best platforms to buy ICOS

One time you have located the most promising ICOs and have entered the list to acquire themthe next step is locate the platforms in which you can acquire the new Tokens.

Next, we will show you a list of the most popular platforms:

binance.com

It is one of the most widely used Exchange platforms in the world. Provides its users with a platform for trading cryptocurrencies, of which you have access to more than 100 types of digital assets. Binance is just one of the platforms through which you can access new ICOs to buy, in addition to having one of the safest electronic wallets available, from where you can make your transactions quickly and safely.

OKx.com

It’s a cryptocurrency trading center which has more than 20 million users in more than 180 countries, and offers advanced financial information services to traders through the use of blockchain technology. It offers an electronic wallet and allows you to trade hundreds of available cryptocurrencies, as well as presales of future crypto assets and ICOs of tokens for project financing.

Coinbase.com

It is one of the safest regulated trading platforms in the world. Based in the United States, it provides its users with a friendly and user-friendly interface that makes it easy to trade and store cryptocurrencies. It is one of the best platforms for those who are starting in this sector.

It is one of the best options you have available for cryptocurrency trading since it has one of the safest electronic wallets in the world, which can be used to formalize pre-sale transactions and ICOs of new tokens.

bitflyer.com

Is exchange platform was founded in the year 2014 that offers a large number of advantages to its users, among which we can highlight a really understandable and easy to use interface, low commissions and quite interesting security features. It offers coverage for new cryptocurrency projects, giving you access to new ICOs and pre-sales of future tokens entering the market. You can trade using most of the major cryptocurrencies on the market, which you have access to.

BitPanda.com

It is a platform of broker-exchange based in Austria. It was born in 2014 and specializes in the sale of cryptocurrencies, which today has more than 1.2 million users from more than 41 countries. Since it is focused on the European market, it is one of the most used ways in this region to acquire newly created cryptocurrenciesas well as access information from experts to know the details of each ICO and pre-sale.

These are the most successful ICOs in history

In the world of cryptocurrencies, ICOs are a fairly common practiceand although it has been gradually reducing in recent years, It is a fact that some of the best-known and most successful cryptos have come out of this practice..

Let’s see below:

NXT

NXT it is one of the oldest blockchain projects in existence. It was officially announced in 2013 by an anonymous developer who he described the cryptocurrency as a descendant of Bitcoin.

The campaign collected around 16,800 USD for the distribution of 1 billion NXT tokens, giving them a value of 0.0000168 USD. This value, as of December 2017, multiplied until it was worth 1.94 USD per token, making NXT one of the coins with the highest return on investment, this being approximately 11,000,000%.

Spectrecoin

It is one of the most secure token networksthanks to its emphasis on privacy and data protection through the use of a ring-signed blockchain, which makes it untraceable. In 2016, 19 million tokens were sold for a total of USD 15,500, giving each token a value of USD 0.001. Afterwards, the Spectrecoin redefined its value, becoming worth 5.51 USD, which represented an investment return of 676.227%

IOTA

IOTA It is a cryptocurrency designed to be used in transactions of the “Internet Of Things”, where a smart refrigerator can, for example, remember certain products and buy them automatically. Its ICO was held at the end of 2015 and raised more than 400,000 USD in funding. Billions of IOTAs sold for less than $0.001. Its value, however, increased exponentially by December 2019, reaching 5.21 USD per token.

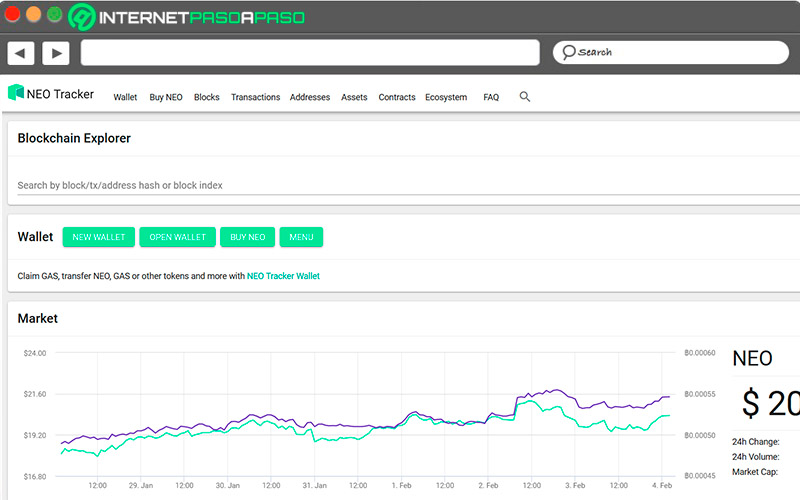

Neo

It is a project created by Chinese developers which is based on the creating a chain of blocks which would represent a legal proof of ownership of the asset, allowing it to be accepted in a general way, without limiting it exclusively to the community of traders.

In 2015 its ICO was held, which was a resounding success, where they managed to sell 17.5 million Neo tokens for the total amount of 556,500 USD, leaving each token at a comfortable 0.032UDS. By the beginning of 2018, each token had reached the value of 162.11 USD, assuming one of the highest investment returns in the history of cryptocurrencies.

ethereum

The ETH is one of the most popular and well-known currencies for anyone who has any kind of interest in crypto assets. It is one of the safest platforms thanks to its open code that allows the execution of smart contracts.

Their ICO, held in the year 2014, collection $15.5 million for the sale a total of 50 million ETH tokens, which left each token with a value of 0.311 USD. Four years later, by January 2018, Ethereum reached a value of 1,377.72 USD, thus representing a return of 441,869%.

Internet