Index:

UPDATED ✅ Do you want to earn money thanks to the volatility of the blockchain markets? ⭐ ENTER HERE ⭐ Learn Everything! FROM ZERO! ⭐

One of the main arguments of the detractors of cryptocurrencies is the huge volatility of their markets. On a normal day we can see not one, but several cryptos go up or down between 10% and 50% without many problems.

But What if I told you that you can take advantage of these price fluctuations? Yes, and it’s all thanks to trading, a form of high-risk investment that allows anyone who loves cryptocurrencies to achieve a very interesting daily return if done intelligently.

In this article we will teach you everything about trading cryptosfrom its fundamentals to the strategies most used by professionals and people who live today from this high-risk investment model, one of the ways to earn money online most famous out there.

What is cryptocurrency trading?

Trading is an investment method in which a platform is used to buy and sell cryptocurrencies in real time, and take advantage of price fluctuations to make a financial profit. For this, use is made of different financial market technical analysis tools, to predict the movements of an asset in a certain time period. There are different types of traders that are mainly characterized by the time period they take into account to carry out their technical analysis.

In this sense we can identify 3 types of trader:

- Intraday: they are people who buy a cryptocurrency and wait minutes or hours until the price reaches the value necessary to achieve the desired profits. It is called intraday because it is done throughout the day, but never more than 24 hours.

- Scalping: It consists of an extremely aggressive trading method in which the trader buys an asset and sells it in a matter of seconds or minutes, achieving shorter but constant profit margins that at the end of the day can leave a fairly high profit percentage.

- swing trading: In this case, you have more patience and usually wait days or weeks until the price of the cryptocurrency reaches the desired value to collect the profits.

- long position: in this case you have even more patience and you can even wait for months until the desired price is achieved. In general, this method is usually done based on higher price objectives, so when it is successful, a profit of double or triple the initial investment is usually achieved.

How does cryptocurrency trading work?

Trading is quite simple to understand; basically we are going to buy a cryptocurrency at a certain price, and then we will wait for a while until the price changes and is located in an area in which, when selling the asset, we can receive an economic benefit. Many people have the idea that these movements can only be upwards; namely, buy an asset and wait for the price to rise to sell it more expensiveso that this upward price difference leaves us profits.

For example, Suppose we have €100 and we buy a cryptocurrency that has a value of €1letting us purchase 100 units of it, after a few hours, days or weeks, depending on the type of trader you are, the price of this cryptocurrency rises to €1.20 what would make the 100 units we have now have a value of €120. being those €20 that we have made our profit from the operation.

But this is not entirely true, since there are two ways of trading that you will learn about below:

- long position: It consists of buying a cryptocurrency and waiting for the price to rise to make a profit, as we explained in the previous example.

- short position: It consists of borrowing a certain amount of cryptocurrencies and selling them immediately, then we wait for its price to fall and we buy it again to pay off the loan, and that difference between the sale price and the purchase price will be the profits.

Nevertheless there are other factors that we must take into account when trading, and it is the subject of the position commissions charged by the platforms or exchange where we carry out the operation. It is usually low, less than 1%, but You always have to be careful because there are some platforms with extremely high commissions which can directly affect the earnings gained.

Trading vs Holding Which is better?

Besides of trading, There is another way to invest in cryptocurrencies; the holding. This is a long-term investment modality that consists of buying an asset and keeping it for years or even decades.hoping in this way that the price in the long term is multiplied by several exponents to the initial value.

As for whether it is better than trading or not, everything will depend on the type of investor you are. In general, people who are dedicated to holding have little time to dedicate to always be aware of the indicators and charts that a good job of trading requires. Therefore, they prefer to bet on the long term regardless of whether the asset goes down or up in price.

In addition, trading is considerably riskier, because if a prediction does not turn out the way it is proposed, you can end up losing moneyor at best with part of your capital frozen until the cryptocurrency you entered goes up to avoid losing a percentage of it.

So that it all comes down to the risk you are willing to take, and the time you want to dedicate to the type of investment you want to apply. Although it should be noted that if we focus only on the profit potential of either strategy, it is clear that, as long as it is done well, trading is superior.

Let’s suppose you have 100€and you acquire 100 units of a cryptocurrency that costs €1. The first year, it is revalued to €2, after another year its price falls to €1.5, but a year later its value is €3. If you did hold for all this time, you would have exactly €300. But if you had traded, things would be different.

If you sold your 100 units at €2, you would have gotten €200 and then bought at €1.5 which would have given you 133.3 units of the cryptocurrency in question, so that by the time its price reaches €3, instead of having €300, you would have 400€, namely more than 30% extra fiat money. This taking into account only 3 years and quite conservative prices.

Risks of trading cryptocurrencies

As you may have understood up to this point, trading is a “wonder” but it also has a high risk.

Among the most important we can highlight the following points:

unpredictable market

Yes, its main virtue is also the greatest risk that exists. The high volatility of the crypto markets makes it virtually impossible to predict a move with 100% security. A Although all the indicators make you think that a cryptocurrency is going to go up or down, in the end the movement can do the opposite.

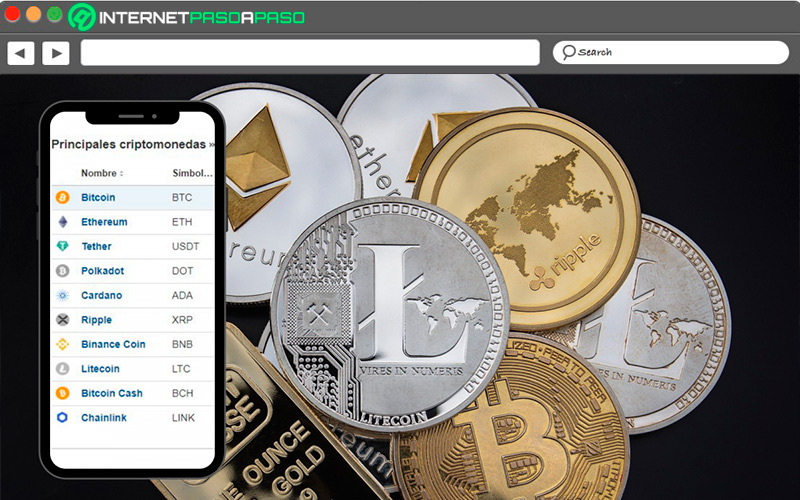

This is the main reason why many people around the world prefer the security of the holding company, and rate trading like a bet equal to going to the racetrack and putting money on your favorite horse. This is not always the case, there are cryptocurrencies such as Bitcoin or Ethereum that have such a large market capitalization that they enjoy some price stabilityso to cover yourself from this it is best to make a portfolio and “marry” certain reliable cryptos.

pump n dump

It is known as pump to the action of causing the price of a cryptocurrency to rise disproportionately, while the dump is the opposite and it consists of causing the price of a crypto to collapse. Generally they are two strategies that go hand in hand and you will ask yourself, how is this possible? And how and who makes it happen?

Well there are cryptocurrencies that have a low market capitalization, and in turn there are millionaire investment funds or directly people with enormous capital, known colloquially as “Whales”, that have the ability to inject a large amount of money into said asset, causing its price to rise disproportionately. The price of a crypto is directly linked to its market capitalization and available units.

In other words, a cryptocurrency that has a capitalization of €1,000,000 and has exactly 1,000,000 units available has a value of €1. Then What would happen if a single person directly injected €500,000 into that market? because the capitalization of the same would rise 50%, therefore its price would go from €1 to €1.5 and the 500,000 units that that whale bought now would have a price of €750,000.

The trick is in once the price of the crypto has risen to that desired 50%, sell all the units purchased, i.e. take that $500,000 out of the market capitalization, which will automatically cause the price to collapse by at least 50%. In this way, the whale gets €250,000 without disheveled and those who have entered at the end, motivated by that resounding rise, lose their money or a large part of it.

scam projects

Pitifully, nowadays anyone can create a cryptocurrency without even having much knowledge about cryptography. There are platforms like pancakeswap either uniswap where with a couple of clicks you can publish your own token, wait for a lot of people to put their money in it and then sell your units and leave everyone without their money. THIS IS NOT ADVICE, is a CAVEAT.

For this reason, before investing in any project, either with intentions of trading or holding, you should investigate its origins well instead of trying to find the new BTC that will make you a millionaire. You should always focus on knowing the usefulness of the token in question, the technology behind it, and especially its founders.

international regulations

One of the main assets that cryptos have is their decentralized nature, which allows them to function without the intervention of any fiscal, governmental or banking body. However, many nations have seen the freedoms that cryptocurrencies offer drug trafficking, organ trafficking and other illicit businesses to launder moneyfor which dozens of measures have been implemented to regulate its use.

These regulations are getting stricter. which makes the market wobble, especially when they occur in countries like China, Russia or the United States, where the largest number of investors in the crypto world are concentrated.

How much money do you have to invest to live trading?

This is a question with a very ambiguous answer that will depend on the monthly living expense that each investor has, which is intrinsically related to the country in which they are located. In Latin America, the average spending of a person is around €200 per month, while in the United States spending on food and basic services is around €200. €1000 monthly. Now, how much can you earn trading per month?

A return based on the numbers achieved by large traders worldwide, is around 20% of the monthly investment, with profits of between 0.5% and 2% daily. Namely, if you move €1000 per month, you can aspire to generate about €200. Some “Sellers” will tell you that it is possible to get a daily yield of 10%, but this is a fairy tale. Of course, there is a certain probability of having lucky breaks and taking advantage of movements of 50% and even 100% in a single operation, but this is simply that; a lucky break.

Anyone who has ever traded in their life will know that the reality is much harsher. But going back to the initial question, how much money would you have to invest to live on trading? Well if you live in Latin America “it will be enough” with between €1000 and €2000while if you live in a first world country the figure can rise from €10,000 to €20,000 depending on the lifestyle you lead.

don’t use your savings

You must bear in mind that it is a high-risk business, so it is never advisable to invest all the money you have available in the hope of living on it and traveling around the world without a problem. In these cases, and believe me we are not playing with this warning, You should only invest money that you are willing to lose.. Do not go into debt or use your emergency savings in such a risky activity. Why? For one simple reason.

The crypto market is extremely volatile and you will never be sure what is going to happen. This makes each movement have a strong psychological factor.. If you invest €1000 that you have left over in a cryptocurrency waiting for its price to go up and it actually goes down, there will be no problem because you just have to leave the money there, wait a few days or weeks and the price will most likely return to the point where you entered (provided you entered at a point with common sense obviously).

But this is not a luxury that you can give yourself if you enter with the money that you cannot lose. What will happen is that you will get stressed, desperate and you will lose, reducing your capital and at the end of the month your earnings will be minimal and you could even have no earnings.

Learn how to trade on Binance

Now we are going to teach you trade cryptocurrencies from Binanceone of the best crypto asset exchange platforms on the planet, as well as being one of the safest in existence.

What you should do is follow the steps you will see below:

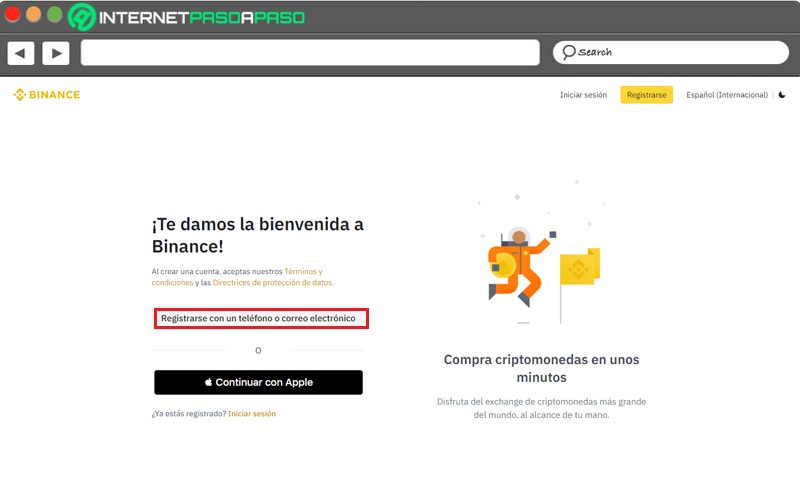

creat your account

It first thing you need to do is create an account on the platform if you don’t already have it.

It is a simple process that you can achieve by performing the following steps:

- Go to the website of

Binance.comand select the option “Check in”. - Then select “Sign up with a phone or email”.

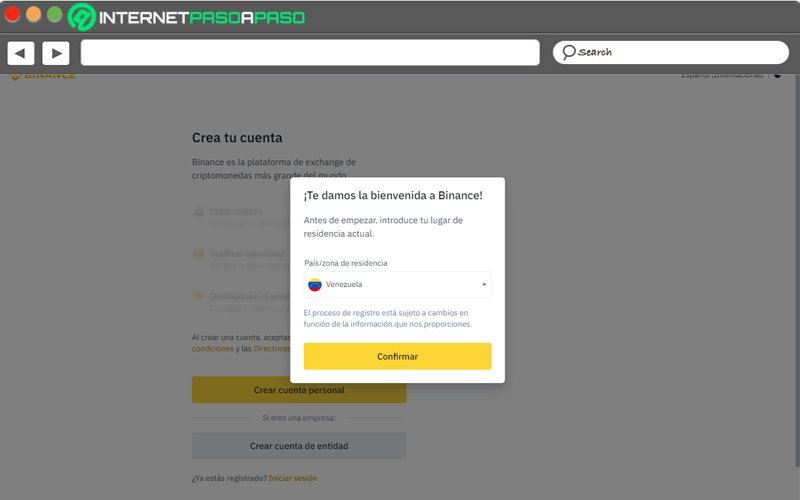

- Now you will be redirected to a page where you must select your area of residenceIt is important that you choose the correct one.

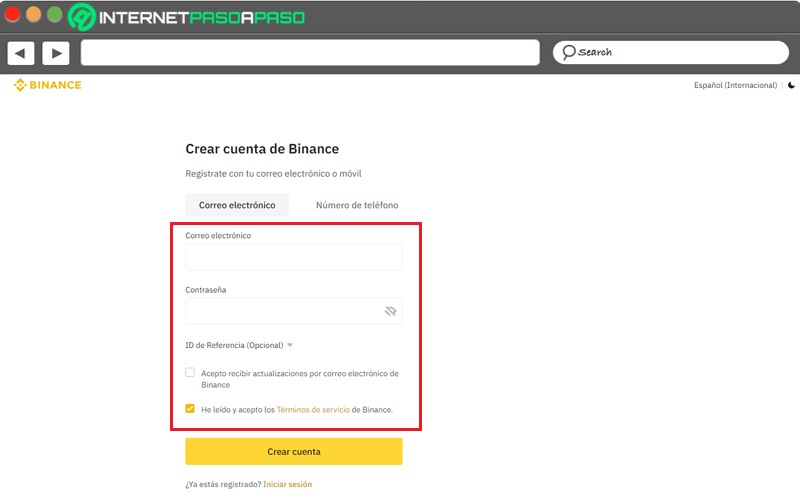

- Finally, complete the registration form with the information requested and click on “Create Account”, and ready you already have your user Binance.

Later you will have to complete KYC or Know Your Customerso that you can deposit and withdraw money in large amounts, but this is optional.

Deposit funds

The next thing you need to do is fund the account.

To do this, you will follow the steps that you will see below:

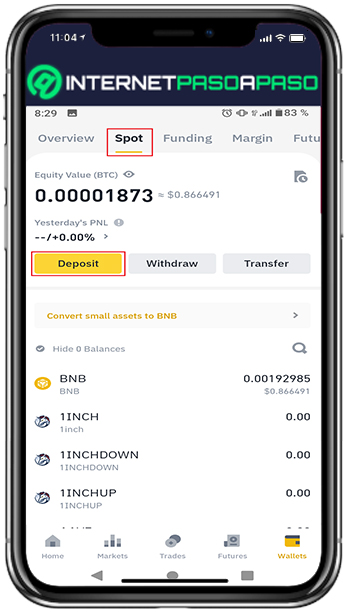

- Sign in to your account and go to the section “wallets” and select the wallet “Spot”.

- Once there select the option “To deposit”.

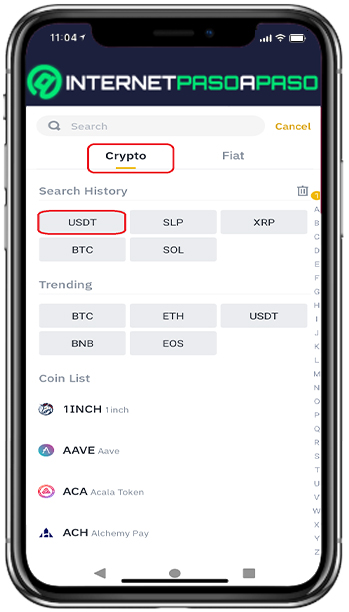

- In this case we will make a crypto deposit with the cryptocurrency “USDT”, so we select it.

- Now we will have to choose the network through which we are going to send the moneyin this case we chose Tron TRC20 because it is one of the ones that consumes the least commissions.

- Now we just have to copy the address and use it to send us the money and that’s itin a matter of a couple of minutes we will have the money in the account.

Make your first trade

One time we have the money in the account we proceed to do the first exchange.

To do this, you simply have to follow the steps that we explain below:

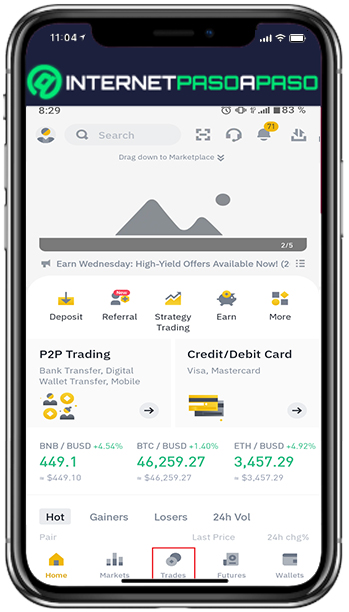

- Enter the section “Trades” from the app to Android.

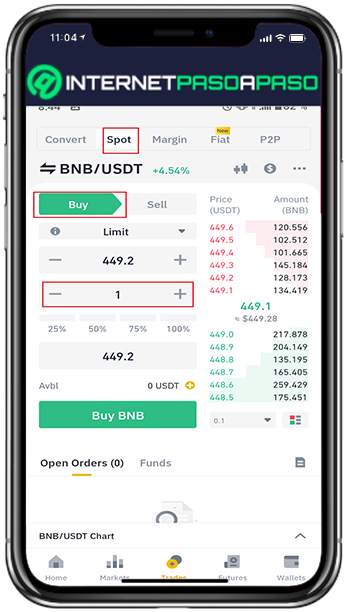

- Make sure you have the option selected “Spot” since that is where we deposit the funds. Once there, select the currency pair that you are going to exchange, in our case it will be BNB/USDT.

- Now we indicate the amount of BNB that we are going to buy, in this case it will be only 1 BNB, and we make the purchase order in the option “Buy BNB.”

Once we have bought our BNB, we can only wait for its value to rise a little and we proceed to carry out the following steps to make the sale and collect our benefits:

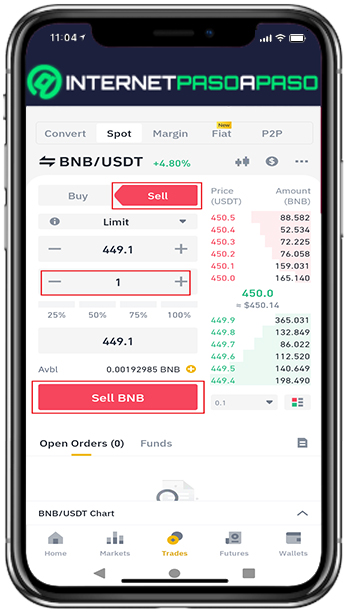

- We came in “Trades” again.

- Now we enter the same pair but select the option “Sell”.

- This time we indicate the amount of BNB that we are going to sell, which in this case will be 1BNB which was what we bought previously, and we select the option “Sell BNB” to place the sell order, and that’s it.

It’s that simple buy and sell a crypto. Obviously there are other things you need to do before you sell like carry out the respective analysis of the cryptocurrencyBut that’s a topic for another article.

Trading signals. Is it worth paying for them?

In recent years, it has become popular “Signs” trading. This is nothing more than data that some traders share from their analysis, indicating cryptocurrencies that according to them can rise or fall in value, in order to take advantage of the movement and make a short or a long. However This works? The best thing is that you always carry out your own fundamental analysis of each asset in which you are going to invest.

However, it is true that there are certain traders with years of experience who have their credibility and their success rate, in addition to the fact that they often have privileged informationbut in reality they are very few so we WE DO NOT RECOMMEND PAYING FOR TRADING SIGNALS. The best thing is that you learn to do your own analysis and make your moves based on them.

Best Cryptocurrency Trading Strategies

Now what you have your account openit’s time for learn the main strategies used by professionals to carry out their operations.

Among the most outstanding we can mention:

- Dollar Cost Average (DCA): It consists of buying a portion of a cryptocurrency every day regardless of its price, so that over time we accumulate a significant amount that, by averaging all the prices at which we have bought, we always have profits in the balance.

- Fundamental analysis: As we explained in the first paragraphs of this article, this consists of analyzing the economic bases of a company or project behind a cryptocurrency to evaluate its long-term growth potential, so that when investing, we are doing it thinking not of getting quick profits, but over time.

- RSI Divergence: It consists of taking advantage of the divergences between the Relative Strength Index (RSI), a very popular indicator among technical analysts, and the price trend of a crypto asset.

- Breakout Trading: This method consists of entering cryptocurrencies once they have broken out of some price pattern, being an investment style based on technical analysis.

cryptocurrencies