Index:

UPDATED ✅ Do you want to know more about cryptocurrency staking and how to earn money with it? ⭐ ENTER HERE ⭐ Learn Everything! FROM ZERO! ⭐

In the cryptocurrency mining, the Proof-of-Work (PoW) protocol has completely dominated despite its obvious limitations and high cost of operation. It is because of that this new protocol has been developed.

The Proof of Stake (PoS) has been gaining ground in the world of cryptocurrency mining for years, so it is not surprising that in the next few years it will be the new main protocol of the blockchain world.

In this article you will know in detail what PoS is and how you can earn money online with itpractically doing nothing more than providing liquidity to a cryptocurrency.

What is cryptocurrency staking?

It is a way to obtain new cryptocurrencies thanks to the Proof of Participation (PoS) protocol. This is a form of investment very similar to the holding company, with essentially two differences; staked funds cannot be used freely since they are locked for a certain amount of time, and while this happens the user generates profits in the cryptocurrency that stakea.

It is a very popular form of investment today that is gaining ground on the holding company due to the obvious economic benefits it offers in the long term. Today there is a huge amount of cryptocurrencies that allow their users to lock their funds to achieve returns of more than 50% per year and even more depending on the project chosen.

How does cryptocurrency staking work?

To understand staking, you must first know how the PoS protocol works. This is a consensus protocol developed to ensure the security of a blockchain network by requesting proof of possession of the asset in question. for the create a new block. In other words, in order for a miner to verify a transaction, they must give the system proof that they have enough locked cryptocurrencies.

In this protocol, the computational power is replaced by the power of possession, making the probability that it wins a block and obtains the corresponding rewards, is completely proportional to the amount of cryptocurrencies it possesses. When staking, what you are doing is simply bringing liquidity to the market of a cryptocurrencyliquidity necessary to carry out the operations, and in return we receive compensation, similar to what cryptocurrency miners do with the PoW protocol.

Treasury and cryptocurrency staking

The last July 11, 2021the Treasury of Spain launched the popular “Anti-Fraud Law”in which, among other things, it is specified that from that moment the cryptocurrencies had to be declared like any other tribute, with fines of up to 5,000 euros against those who ignore these measures. However, for now the Spanish government is only focused on cryptocurrency mining and trading activities.

So they “forgot” about other modes of investment such as DEFI and also cryptocurrency stakingwhich makes for now You do not have to pay taxes or report any type of activity related to these two types of investment. Although it is not ruled out that in future decrees some coercive measure may be applied.

Differences between Proof of Work and Proof of Stake

Before the pos, the protocol used for mining cryptocurrencies like Ethereum or Bitcoin is the PoW or Proof of Work protocol. With this you use a model in which the nodes or miners must provide communication power to the network to get the rewards for winning a block.

Some of the differences between the two are as follows:

Accessibility

The big problem with the PoW protocol it is that the competition becomes practically inaccessible for the small investor. Today it is almost impossible for a person with 10 miners at home, compete against the huge existing mining farms in countries like Venezuela or El Salvador. So the mining business becomes quite elitist, only 100% used by investors capable of creating large systems.

With staking things change, and anyone with any capital will be able to participate in the process of creating blocks on the chain regardless of the amount of money they havealways receiving rewards proportional to the money they are investing.

maintenance costs

In addition to need a large investment to start mining with the PoW system, The maintenance of these miners is also expensive; they must be cleaned constantly and invest in powerful cooling systems due to the enormous amount of heat they emit. In addition, a specialized electrical installation must be created with voltage protectors that protect the equipment against any power failure.

When staking, the investor can forget about all these issues since he only has to put his funds in a wallet and block them to be used in the network and that’s ityou can completely forget about them and they will continue to generate profits.

network vulnerability

The reason why, despite its obvious disadvantages, PoW is still used, is because of its enormous reliability as a network. The security that this protocol provides to the blockchain where it is implemented is simply spectacular, something that cannot be said of the PoS protocol.

One of the most dangerous problems is the fact that the miners themselves could attack the network for their profits. This is what is known as “The Problem of Nothing at Stake”which is the probability that a node will try to create a fork of the blockchain without losing anything in return, since it does not need to invest work for it.

Proof of Stake issues

Yes ok This protocol presents great facilities and economic benefits for its miners.at the network level it is far from perfect, which has greatly delayed its final adoptionthus managing to completely displace the PoW.

Some of the more serious problems are as follows:

Nothing in Game Problem

This issue poses a scenario where a miner might be tempted to fork the chain because there is virtually nothing to stop them, and because you really have nothing to lose but a lot to gain. A fork in the blockchain world consists of the modification of the consensus rules within a network, which can end in a division of the original blockchain.

The reason this happens is because the odds of success in a block are given by the amount of staked funds. This means that a miner with large funds, say 20% of the total liquidity of the network, can continue mining without any problem while trying to create a fork, since if he fails, he will not have lost anything.

This does not happen in the PoW protocol, where the miner must make a decision: mine to get the block or attempting to create a fork that if failed would mean that you invested computing power that could have been used to continue mining.

To the have less chance of success when attempting to make such a fork, will always end up deciding to continue mining. Of course there have been solutions to this problem, such as the fact that apply sanctions to all those miners who try to fork the chainbut are still in the process of Test.

Asset Exposure

The probability of winning a transaction with staking is directly proportional to the number of units that are blocked in the system. This is a blessing, but at the same time a problem because means that the coins will always be connected to the network while working on the networkwhich means that they will be constantly exposed to possible attacks.

Although this is considered a minor problem given the advanced security protocols that exist in the cryptographic world, it is still a possibility that worries many. For this, alternatives to direct staking have been created. One of the most popular is delegated staking or DPoS, in which the nodes that own the cryptocurrencies delegate their rights to other representative nodes that will be in charge of carrying out the process without having to expose the funds. One of the most popular networks that use this system is Bitshare.

save to attack

Staking allows miners to reinvest their own earnings to increase mining power and in turn improve their rewards. The problem with this is that a miner could save for a certain time until he got enough staking power to perform an effective fork, which is not even possible to discourage even by implementing penalties for such miners.

51% problem

Lastly, there is the risk of a miner getting the 51% participation rate. If this happens, the miner could start mining on top of his own blocks, which would gradually earn him enough rewards to get 100% staking power, thus taking full control of the chain. This would happen even if a new miner with a high participation entered the network.the 51% miner would eventually own it and thus get the 100% participation.

In the mined with PoW this does not happen since a miner to gain participation rate must improve his computational power, And even if I get a 51%, a new miner with more computing power than this one can always emerge.

How to choose a coin to stake?

Staking should be viewed as a long-term investment in which you are betting on asset appreciation within at least six months.

For this reason, each analysis should be based mainly on the fundamentals of the cryptocurrencies that you are going to choose to stake:

Project

The first thing you should analyze is the project behind the cryptocurrency in question. The detail is that to know if a project is worth it or not, you will have to soak up enough about the crypto world. If what is behind a token is a chain link protocol, you should know about it, and how something like that can improve the market.

Don’t get carried away by the first coin that has a small bullish rally. Projects like Cardano in 2020 or Solana in 2021 were successful because they presented an improvement that in turn represents an improvement for the crypto ecosystem in general. So when choosing your investments, do enough research and ask acquaintances or friends who really have knowledge about it instead of following the first youtuber to death let it cross your path.

growth potential

This is related to the level of the project you are on. For example, the token AXS had a fantastic 2021, but its growth potential has not yet been reached. This information is valuable because with it you will learn when it is the right time to enter a project.

The growth potential is measured taking into account several factors such as those mentioned below:

- issued coins: the market circulation of a crypto asset is essential to define the possible maximum price reached. If you have an asset with a high issue, we can expect a low price of less than $100 unless its demand is too high, as in the case of BTC. While if you have a cryptocurrency with a low emission, we could be in a scenario of a coin that, if it reaches a good market capitalization, could reach prices above $100, as happened with Solana.

- Utility: In the world of cryptocurrencies, the usefulness of a token is essential to determine its future possibilities. If we are dealing with a token that hardly has utilities beyond representing a technology or protocol, then it is possible that over time the price expectation will not be as high.

fundamental analysis

Do a fundamental analysis is a necessary task before making any long-term investment, since in this analysis you will be able to know the real advantages and disadvantages that the project has and its chances of growing over time.

Among the things that you should analyze in a fundamental analysis we have the following:

- Current and future situation of the world economy: in this sense, what is sought is to know the scenario in which the project will be founded and how it could behave in the face of any economic change in the future. For example, oil today is a good investment, but given the evident growth of clean energy, perhaps in 20 years oil will be worth the same or less than a soft drink.

- Team behind the project: It is not a guarantee of success, but it certainly says a lot about the potential of the project if you know that the team behind it is truly capable of taking on the challenge.

- Blockchain Analysis: spend time analyzing the behavior of the transactions in the project’s blockchain, in this way you can make sure that there are no signs of manipulation of the chain or other vulnerabilities.

- Project Roadmap: It is essential to know what the next steps will be that the developers will take regarding the project. This can be seen in the roadmap drawn within the company’s Whitepapper.

Funds you don’t need

Finally, a recommendation that all the big investors want you to follow; don’t use money you can’t afford to lose. The cryptocurrency market is very volatile, And if you don’t want to lose money, the only way to avoid it is to be patient. It’s no use to you enter with money that in two months in case of any emergency you will needsince if by bad luck this happens at a time of market correction, you will almost always leave with a loss.

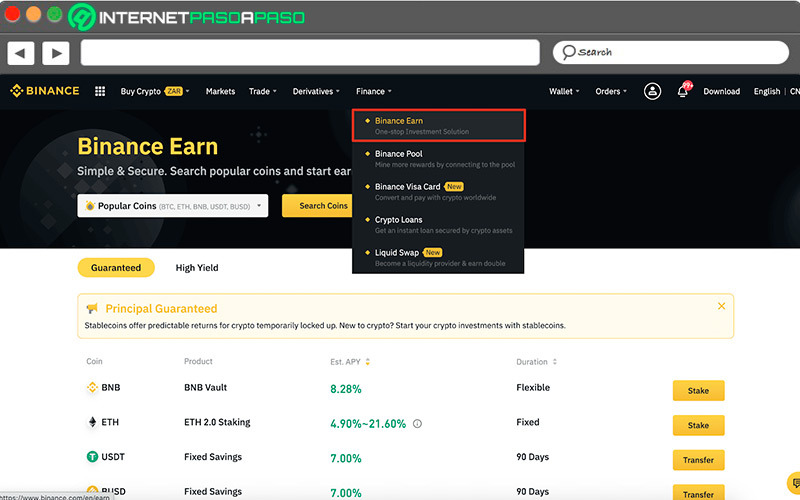

Learn how to stake on Binance

Next We are going to teach you step by step how to stake on Binance, one of the most popular cryptocurrency platforms in the world.

You will learn from how to register to how to make the long-awaited staking:

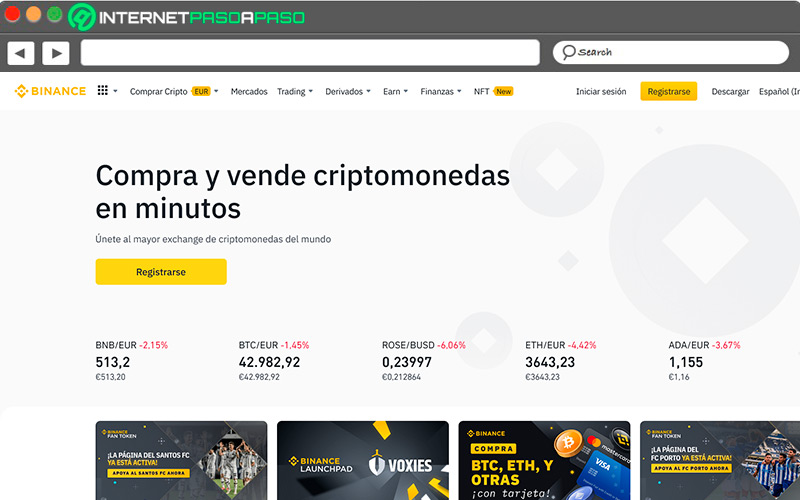

Check in

The first thing is to register on the platformthis is an extremely simple process in which we will have to go to the website of Binance.comto later search in the upper right corner of the display the option “Sign up”. By doing this, you will be redirected to the registration form that you must complete with your data, email and telephone number, among other things.

Complete KYC

Once you have confirmed your registration, it is time to verify your identity, otherwise you will not be able to move large sums of money with your account. To do this, you must go to “Profile”and once there you will look for the option “Verify Identity”. Once you do this, you will start a process in which you will have to send a photo of your face and another of your national identity document or passport. Once you finish the process you must wait a couple of hours, although sometimes it could be up to 48 hoursand ready you can use your account without limitations.

deposit funds

Once we have our account 100% verified, it is time to deposit the funds into the account. In this case we have three financing options.

The first is to deposit cryptocurrencies, for this the steps are as follows:

- Go into Wallet and later in “To deposit”.

- Now you must select the option “Cryptocurrencies” and proceed to choose the cryptocurrency you want to deposit.

- Now you just have to select the network you will use for the transactionand then copy the address that it indicates.

- In this point you must go to the wallet or platform in which you have the cryptocurrencies that you will deposit, and proceed to make the shipment to the address you copied from Binance without forgetting before selecting the same network.

The second way to make a deposit on Binance it is through the P2P market that the same platform offers.

To do this, the steps are as follows:

- Go into “trading” and then select the P2P option.

- Once there enter “Filters” and choose the currency of your country and the payment method that you will use, be it bank transfer, cash or deposit.

- Now select the option “To buy” and a list of ads of people from your country who are selling the cryptos you need will appear before you.

The process for buy cryptos via P2P it is completely safe because Binance will be the intermediary between both traders, which guarantees that the business will be legitimate. Similarly, follow the recommendations of the platform and only do business with verified buyers.

Finally, accounts with the fiat currency deposit. For this, what you should do is the following:

- Go into “wallets” and select the option “Deposit”.

- Once there select the option “Fiat”.

- Now you must select the Fiat currency in which you will make the deposit.

- Each currency has its own payment methods. For example, if you want to deposit euros, you can do it with a debit or credit card, bank deposit in cash or through the platform’s P2P, while if you want to do it in USD (United States Dollar), then you will have to do it only by SWIFT bank transfer.

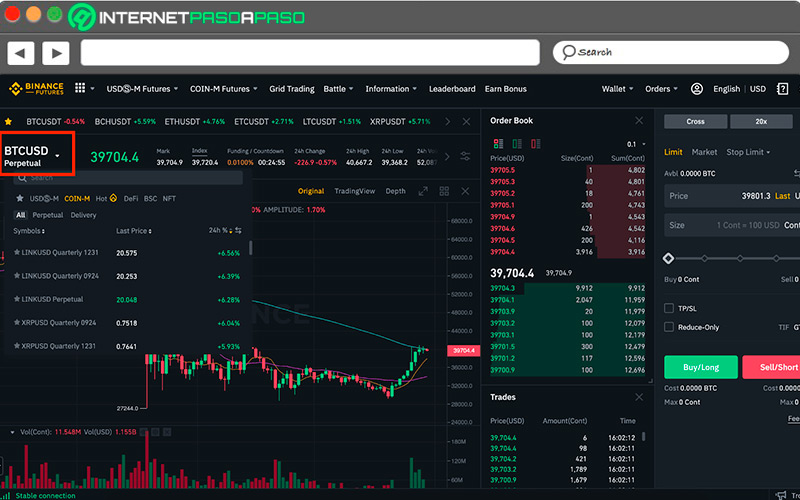

Stack funds

Once you have the funds in your Binance account, the staking process is quite simple, you just have to follow the steps that I explain below:

- Go to the main page of Binance and select the option “staking”.

- Once there you will see all the staking options available on the platformyou should look both at the time that you will have the money blocked, and at the annual return that the investment will give you.

- When you have already decided what cryptocurrency to put your funds in, go to the traditional trading market and buy the amount you want to stake.

- Once you have everything it’s just going to “staking”, select the desired offer and choose the option “Stake Now”.

- Now You just have to confirm the operation with the double factor verification and that’s it, your funds will be staked.

Best cryptos for staking

Now what Do you know how to do the staking process on Binance?surely you really want to start investingbut surely you do not have any cryptocurrency in mind.

That is why we are going to share a list of options that is not wasted below:

Polkadot

Polkadot is possibly one of the best cryptocurrencies for long-term staking since the growth potential of this project is considerably high. His project consists of the development of a decentralized protocol and open source that makes interoperability between different blockchains accessible.

It is a very ambitious project that seeks to make cryptocurrencies much more scalable and that allows a correct interrelation between them. It is expected that in a couple of years, Polkadot has a similar market capitalization as USDT has todaywhich would raise its price above €100 without any problem.

Cardano

Many call him the “New Bitcoin”, and it is that the Cardano ADA token seems to be destined for greatness due to the usefulness of the project. It is a fairly simple initiative, an open source blockchain and a platform for creating smart contracts.

This may seem like a small thing but the utility it can have in the blockchain ecosystem is enormous. First of all, its contracts are much easier to trade on multiple chains, not to mention the fact that it is the largest PoS cryptocurrency in the world today.

avalanche

This is another smart contract creation platform that has its own open source blockchain. It’s basically the same as Cardano, with the difference that in this case we have a little less scalability than in ADA. It is a good Staking option since it is estimated that in a couple of years its price will have tripled in relation to its current value.

Best platforms for staking cryptocurrencies

Now we are going to introduce you to a series of platforms where you can start making your first Staking operations:

Nexo.io

It is a crypto bank where you can stake a huge amount of cryptocurrencies. It is not the best option in the world in terms of returns, but it is certainly an option that we should all consider as it offers options to stake stablecoins at yields between 8% and 10%but with the advantage that we have liquidity available daily without having to depend on a fixed term.

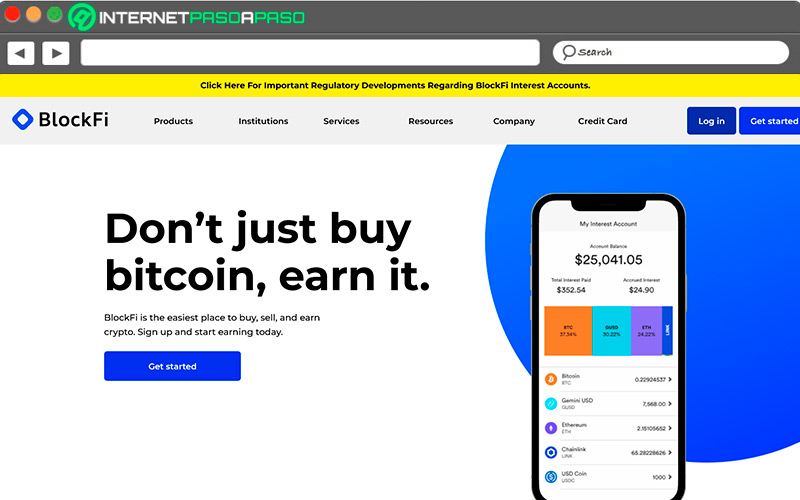

BlockFi.com

Another interesting option that this time offers a yield of 8.5%. It has a wide variety of cryptocurrencies to stake. However, this time it will not be possible to have immediate liquidity, but we must depend on a fixed term of about 30 days to have 100% of our funds.

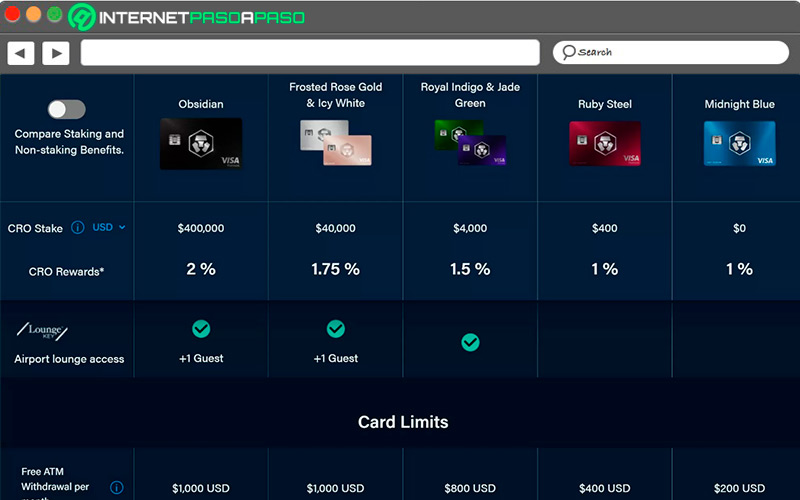

Crypto.com

This is an excellent cryptocurrency platform, very currently recognized for its stablecoin staking plans in which it offers a return of 10%In addition to being quite reliable. In this case we will have a fixed term of three months and the liquidations of your commissions are made every week.

Bybit.com

This is one of the most important exchanges in the world along with Binance. In it you will find extremely good staking plans with a yield of up to 17%. The problem with it is that exchanges with stablecoins are not always available since they are for quotas, but the returns it offers are completely worth it. You will also find more profitable staking options, but with the risk of doing so with much more volatile assets.

Internet