Index:

UPDATED ✅ Apple Pay is an exclusive mobile payment service for iOS that allows you to pay quickly and safely from your bank ⭐ ENTER HERE ⭐ Learn more

Apple has always been characterized by its cutting-edge technology and the high quality of what it offers, and although this company does not diversify much in its products, they do have well-diversified services.

For a few years now, first in the United States and then in the rest of the world, A powerful payment technology has arrived that makes this type of purchase much easier.

That is why today we are going to talk to you about the apple mobile payment method, and how you can get the most out of this technology, without further ado let’s continue.

What is Apple Pay and what is this service for?

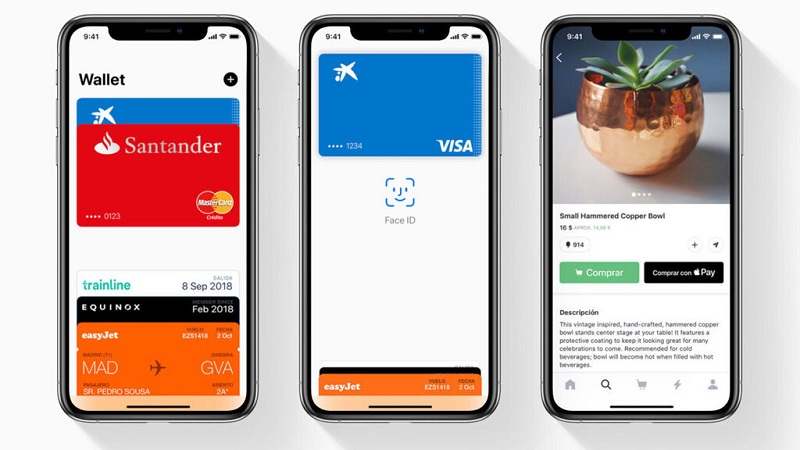

Apple Pay is a service from the great Apple company that seeks to streamline all physical or virtual purchasing processes, reducing them to a single touch. This service begins to be available in a large number of retail stores from the year 2014.

This mobile payment can only be used through an iPhone 6 or later. In the same way, only iPads from the sixth generation onwards are compatible with this payment method. It can also be used on Apple Watch and Mac computers that include Touch ID.

This allows the user pay for your products without the need for a debit or credit card, saving time and solving some security problems that affect these methods.

How does Apple Pay work? Start using your Wallet

It is said that Apple’s mobile payment service is only available from iPhone 6 onwards, this is due to the operation of the technology implemented in these devices. Well As of this version, mobile phones began to have an NFC technology chip or near field communication.

This makes it possible to exchange data at high frequencies and speeds over very small distances or close proximity. Which means that bringing the equipment closer to a point of sale immediately activates an exchange.

This technology is what makes purchases possible in physical stores that have implemented this payment method.

For this purchase to be successful, these mobiles also they have another little technology called secure element or SE. This is responsible for assigning a secret and random code, unique for each exchange made. Therefore, it is impossible for it to be replicated or falsified.

Finally, for the purchase to be completed, the user must confirm the transaction by means of a biometric voucher, which is activated with the fingerprint.

This latest technology is Apple’s Touch ID, and together with the secure element, they allow both purchases in physical stores and online stores.

It is also important, of course, that you previously have some credit or debit card associated with your Wallet on the iPhone. If you have not done this, this will be explained in the next point.

How to add a card and use a card to Apple Wallet?

The procedure of adding cards to your Wallet can be done in 3 different ways in the different compatible equipment. It should be noted that For these procedures to be successful, the card and the bank must be consistent with this form of payment:

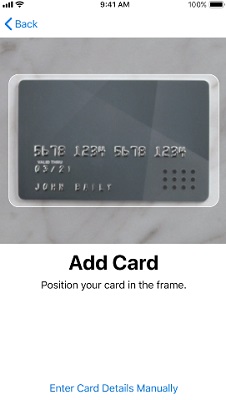

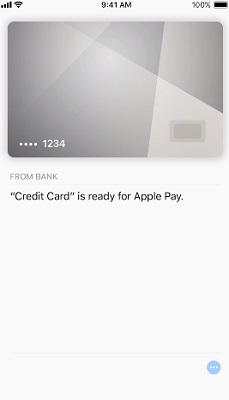

To Add from iPhone or iPad

The process is simple, You just have to follow the instructions as we indicate them:

- The first thing is to access the Wallet application, then you will have to click on the “Add more” located in the upper right corner.

- There depending on the system version of your device, you may be asked fill in the card details along with the security codes. They may also ask you to confirm that you download the application of the bank in question.

- In case you have the latest iOS versions, This indexing process is done by scanning.

- The next thing to do is follow the instructions of the bank, which will be specified after the scan.

- Once this process is complete, you must wait for the bank to process and verify your card. Process that can take as long as it needs.

To add from Apple Watch

This procedure is valid for when you have an Apple Watch, but you don’t have an iPhone higher than 6:

- The first thing is to enter the iPhone in the application “Apple Watch”, once we choose a clock we must click on “Wallet and Apple Pay”.

- Next, we must enter our card details with security codes.

- Finally, we must follow the specifications of our bank and wait for the card to be verified to be able to make purchases with the Apple watch.

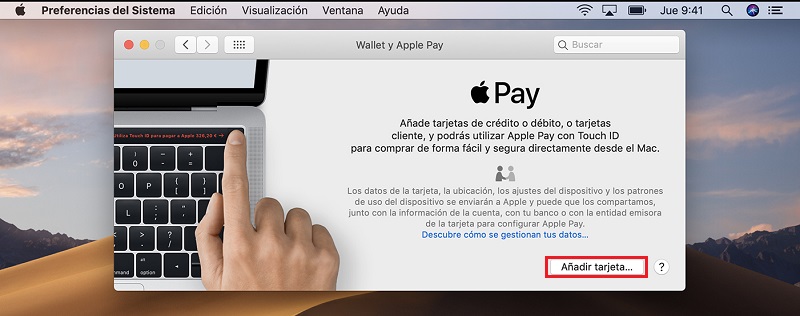

To add from Mac

To be able to make purchases online with your Mac this must have biometric recognition technology.

In case you do not have it, you can enter the iPhone, iPad, or the Apple watch, and in “wallet” activate the option “Allow payments on Mac.”

- If your Mac has Touch ID, then we need to go into “System preferences”, and in the wallet options select “Add card”.

- Once we add the card data, we follow the instructions of the bank and wait for them to verify the information to start making payments online.

What types of cards does Apple Pay accept?

According to the Apple support page, we have that Apple Pay is compatible with the following types of debit and credit cards:

- MasterCard.

- Visa.

- American Express.

- JCB credit card.

- UnionPay.

- China UnionPay.

What are the main advantages of using Apple mobile payment?

Let’s see what are the main benefits that we can get from making our purchases with Apple’s mobile payment.

Fast payments to physical or virtual stores

The speed It is something that characterizes this type of payment, since it is only necessary to bring the mobile, watch or tablet close to the point of sale and perform it respectively with the fingerprint.

In the case of virtual stores, we can pay in the same way, just by confirming with the fingerprint and without the need to load our card data.

Secure payments

The security It is another of the strong points of this type of payment, thanks to the element that we mentioned before, which means that each procedure is protected by a unique code. So that even under cyber attack this code does not work.

There is also the factor of that if your mobile is stolen or lost, you will not be able to use this, because it can only be activated by fingerprint biometrics.

Comfort

The comfort of this style of payment stands out a lot, because allows you to carry all your payment cards in a single team, either credit or debit and pay from a single device in stores.

Therefore, also Reduces the risk of your credit card being stolen and lose your money, because with this method you do not need to carry them on top.

List of the main banks compatible with Apple Pay

Now we will know the main banks in the world that accept payments with Apple Pay by region, continent and country:

Pacific Asia

Australia

- suncorp

- National Australia Bank

- ANZ

- Common Health Bank of Australia

Plus 82 other banks.

mainland china

- Bank of China

- HSBC

- CITIC Bank

- ICBC

- Citibank

Plus 127 other banks.

Macau

- National Overseas Bank

- ICBC (Macau)

Taiwan

- Bank SinoPac

- Cathay United Bank

- Citibank Taiwan

- CTBC Bank

Plus 10 other banks.

Japan

- Mizuho Bank

- Mitsubishi CFU

- Mitsui Sumitomo

Plus 121 other banks.

United States / Canada / Latin America

USA

- J.P. Morgan Chase

- Bank of America

- Citi Group

- Wells Fargo

- Goldman Sachs

Plus 3,328 other US banks.

Canada

- Royal Bank of Canada

- TD Canada Trust

- Bank of Montréal

Plus 42 other banks.

Brazil

- Bank of Brazil

- Bradesco

- Itau

Europe and Middle East

Austria

- boon

- Bunq

- Erste Bank und Sparkasse

- Monese

- N26

- Revolut

- VIMpay

- Belgium

- BNP Paribas Fortis

- Bunq

- fintro

- Hello bank!

- Monese

- N26

- Revolut

Bulgaria

- Monese

- paynetics

- Revolut

Croatia

- Monese

- Privredna banka Zagreb

- Revolut

Cyprus

- Bank of Cyprus

- Monese

- R.C.B Bank

- Revolut

Czech Republic

- Raiffeisen Bank

- Revolut

- Monese

Plus 11 other banks.

Denmark

- Danske Bank

- Jyske Bank

- Nikredit

- Nordea

Plus 63 other banks.

Estonia

- Monese

- N26

- Revolut

Finland

- Danske Bank

- Nordea

Plus 8 other banks in Finland.

France

- BNP Paribas

- General Company

- Caisse d’Epargne

Plus 29 other banks in France.

Georgia

- Bank of Georgia

- TBC Bank

- VTB Bank

- Liberty Bank

Germany

- Deutsche Bank

- Revolut

- Monese

Plus 22 other banks.

Greece

- edenred

- Monese

- N26

- Revolut

- Hungary

- IBC

- Erste Bank

- Granit Bank

- Monese

- OTP Bank

- Revolut

Iceland

- arionbank

- Landsbankinn

- Monese

- N26

- Revolut

Ireland

- IBA

- boon. by Wirecard

- Bunq

- KBC

- Monese

- N26

- Revolut

- Ulster Bank

Italy

- Unicredit

- Intesa Sanpaolo

Plus 26 other banks in Italy.

Kazakhstan

- Alpha-Bank

latvia

- Monese

- Revolut

- Liechtenstein

- Cornercard UK

- Monese

- N26

- Revolut

Lithuania

- Monese

- Revolut

Luxembourg

- BGL BNP Paribas

- Monese

- N26

- Revolut

malt

- Monese

- Revolut

Netherlands

- ABN AMRO

- Bunq

- ING Bank

- Monese

- N26

- Revolut

Norway

- Danske Bank

- Nordea

Plus 10 other banks.

Poland

- Raiffeisen Polbank

- Monese

- Revolut

Plus 15 other banks.

Portugal

- Agricultural Credit

- moey!

- Monese

- N26

- Revolut

Romania

- Banking Transylvania

- edenred

- ENG

- Monese

- OrangeMoney

- Raiffeisen Bank

- Revolut

- UniCredit Bank

Russia

- Sberbank

- VTB Bank

- Gazprombank

- Alpha-Bank

Plus 101 other banks in Russia.

Saudi Arabia

- Al Rajhi Bank

- Alinma Bank

- Arab National Bank

- Bank Albilad

Plus 8 other Arab banks.

Slovakia

- 365 bank

- boon.

- edenred

- Fio Banka

Plus 8 other banks.

Slovenia

- Monese

- N26

- Revolut

Spain

- BBVA

- CaixaBank

- Santander

Plus another 40 Spanish banks.

Sweden

- Nordea

- Bansk Bank

- Monese

- Revolut

Plus 7 other banks.

Swiss

- Credit Suisse

- Monese

- Revolut

Plus 23 other banks.

Ukraine

- accord bank

- Alpha-Bank

- alt bank

- Bank Pivdenny

Plus 17 other banks.

UK

- Lloyd’s

- TSB

- Royal Bank of Scotland

- Bank of Scotland

- Barclay’s

Plus 36 other banks.

United Arab Emirates

- Emirates NBD

- Dubai Islamic Bank

- Abu Dhabi Commercial Bank

Where can I pay with Apple Pay?

Apple Pay today has the support of more than 3000 banks in various parts of the world, so its acceptance is practically global. This makes the list of establishments where you can buy with this payment method immense.

Next, We bring you a small sample with some where you can buy with Apple Pay:

- aeropostale

- American Eagle Outfitters

- Manzana

- Babies R Us

- bj’s

- Ginos

- Cepsa

- Average Mark

- Bloomingdale’s

- Champs Sports

- Chevron

- Disney Store

- Duane Reade

- Extra Mile

- FootLocker

- foot action

- House of Hoops by Foot Locker

- Kids Foot Locker

- Lady Foot Locker

- Macy’s

- McDonald’s

- Meijer

- Nike

- Office Depot

- Panera Bread

- petco

- Radio Shack

- Run by Foot Locker

- Six:02

- Sports Authority

- subway

- Texaco

- Women Secret

- Zara

- Zara Home

- VIPS

- Super Core

- Toys R Us

- Unleashed

- Walgreen’s

- Wegman’s

- Whole Foods Market

- anthropology

- Free People

- Sephora

- staples

- Urban Outfitters

- Mundo de Walt Disney

- Bricor

- hypercor

List of virtual stores and Apps that accept Apple Pay:

- Manzana

- app store

- showroomprive.com

- train line

- Zara

- Vueling

- Chairish

- EasyJet

- Etsy

- Fancy

- groupon

- Hotel tonight

- houzz

- indiegogo

- instacart

- lifx

- lyft

- OpenTable

- Panera Bread

- PrintStudio

- Spring

- staples

- target

- threadflip

- Uber

- airbnb

- Disney Store

- Eventbrite

- Jack Threads

- Levi’s Stadium

- MLB.com

- Sephora

- starbucks

- stubhub

- ticketmaster

- tickets.com

- Buy

- Hotel Tonight

- residentadvisor.net

Applications